Brisbane to lead property price rises in next three years: analyst

Brisbane from Mt Cootha Lookout – Jensen Property

First home buyers are being told that there’s no urgency to enter the housing market with house price growth set to remain stagnant in many parts of the country in the coming years.

Property analysts say house prices in Brisbane are expected to soar in the next few years – but first home buyers are in luck with a record number of homes and apartments hitting the market across the country.

With some areas of Australia in oversupply and a pullback in investor activity amid tighter lending rules, those in the market for their first home are being advised to take their time as prices across the country are expected to remain stagnant.

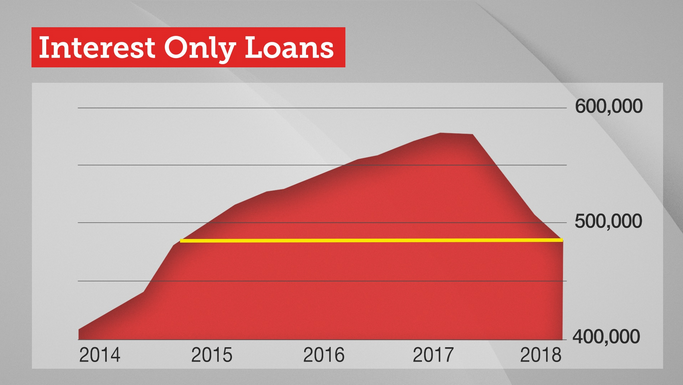

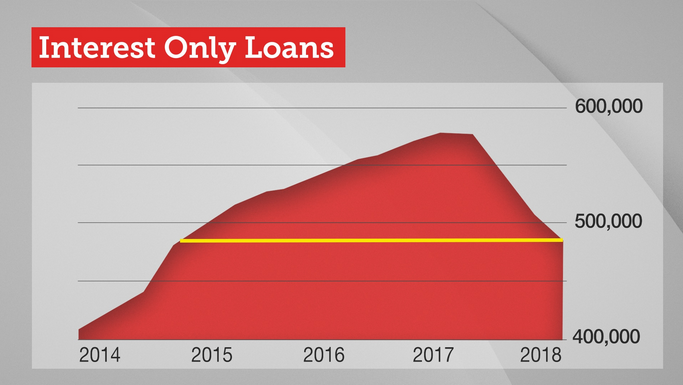

After reaching a record in July last year the banking regulator APRA says the value of interest only loans has slumped to the lowest since January 2015.

Source: APRA/SBS

Property analysts say house prices in Brisbane are expected to soar in the next few years – but first home buyers are in luck with a record number of homes and apartments hitting the market across the country.

With some areas of Australia in oversupply and a pullback in investor activity amid tighter lending rules, those in the market for their first home are being advised to take their time as prices across the country are expected to remain stagnant.

After reaching a record in July last year the banking regulator APRA says the value of interest only loans has slumped to the lowest since January 2015.

Brisbane’s turn to boom

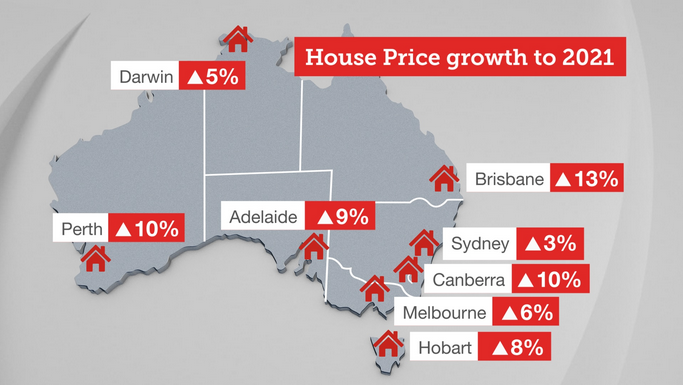

Of Australia’s capital cities, BIS is predicting that Brisbane will see the biggest increase in median prices over the next three years up 13 per cent as population growth catches up when a slowdown in housing construction eventuates in two years.

Canberra and Perth will forecast to grow by 10 per cent while the rest of the country will only see single-digit growth through to 2021 with Sydney only tipped to grow by three per cent.

Source: BIS Economics / SBS

The softer prices are encouraging first home buyers back into the market – accounting for 17.6 per cent of owner-occupier home loans, taking out an average loan size of nearly $343,000.

Super saver scheme

Nerida Cole, head of advice at Dixon Advisory says, first home buyers saving for a deposit can take advantage of the government’s first home super saver scheme.

“Any extra money that they put into super up to an annual limit of $15,000 can then be used for their first home purchase and by using the super system they can get some of the same concessions that super offers and that extra tax benefit is what gives them the extra money to put towards the deposit.”

It means an average wage earning on $80,000 a year, that uses the scheme over two years, would get about a $5,000.

“You would either set it up through the year as a salary sacrifice with your payroll office,” Ms Cole said.

“At this time of the year though, there’s not time to do that, so for the first time employees are actually able to make a lump sum tax-deductible contribution to their super so they can do that right now in the last week (of the financial year) and then they can claim a tax deduction for that contribution and also be able to use it for their first home deposit.”

Complicating the matter though is the possibility of higher mortgage rates.

Bank of Queensland became the first bank in this latest cycle to lift variable rates on a number of its products, independent of the Reserve Bank, blaming higher funding costs.