Brisbane Property Market predictions for 2021

Where will our property markets be in 3 years

That’s a question people are asking now that our real estate markets have moved to the next stage of the property cycle — one of slower growth in some areas and falling values in other locations.

Well there’s good news for those interested in the Brisbane property market forecast.

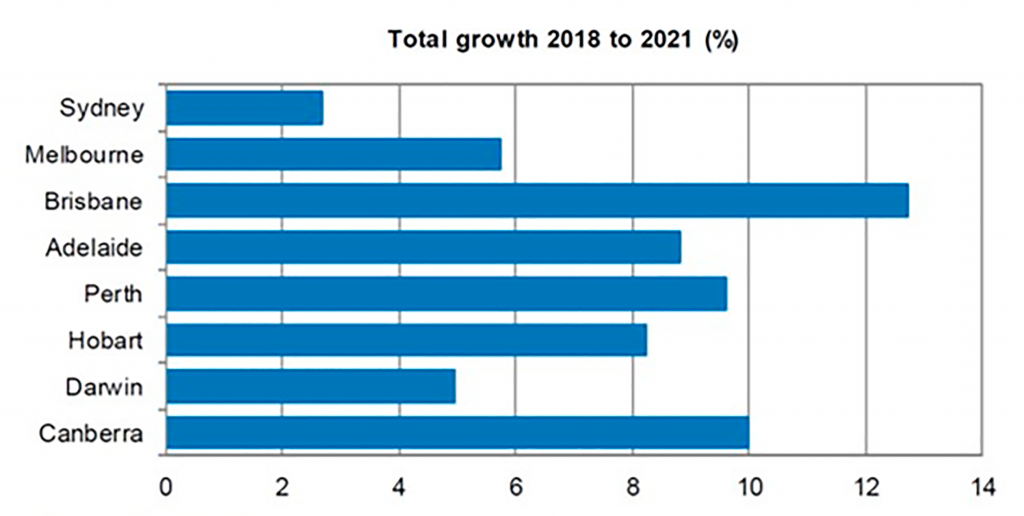

BIS Oxford Economics suggests that while some property markets around Australia will languish, Brisbane’s housing market is likely to be the best performing property market over the next 3 years.

So what’s ahead?

In short…the overall Australian housing market will experience a soft landing with further price falls in the short term.

Taking inflation into account, modest price declines were forecast in most capital cities over the next 12 months.

And then all capital cities will turn around and show price growth over the next 3 years, but the results will be fragmented.

Source: ABC

BIS suggests the current slowdown is due to tighter lending criteria, particularly a crackdown on interest-only loans, and record levels of dwelling construction being completed (above 200,000 per year), which may lead to an oversupply in some states.

Our research suggests there is already an oversupply of inner CBD apartments already — especially in the Brisbane, Perth, Canberra and to a much lesser extent Melbourne property market.

Record population growth continues to fuel demand for housing.

Brisbane Property Market Forecast

Median house price in June: $550,000

Forecast median house price June 2021: $620,000

Growth 2018 to 2021: 13%

BIS’s forecast is that Brisbane will see the strongest growth of any property market over the next three years, jumping 13 per cent to a median of $620,000.

Brisbane’s property market will continue to perform well at a time when many other markets are languishing.

As always, the markets will remain fragmented.

Some areas underperformed, 68 suburbs far exceeded the average level of growth and almost a dozen Brisbane suburbs had double digit price growth over the last year.

While Brisbane house prices are growing, the unit market is still suffering from an oversupply of new apartments.

Amongst the best performing suburbs over the past 12 months were Indooroopilly, where the median house price increased by 24.1 per cent to $1.01 million and Paddington where the median house price rose 19.8 per cent to $1,269,500.

Brisbane real estate has been buoyed by steady population growth driving demand and underpinned by good economic fundamentals including jobs creation and a low unemployment rate.

Queensland has now become the number-one destination for internal migration, taking over from Victoria and overseas migrants are starting to see Brisbane as the place to be, bringing 12,847 residents into the city.

With the supply of new and off the plan apartments in Brisbane’s CBD and inner ring outstripping demand, and estimates of another 15,000 apartments flooding the Brisbane market in the next year, there is little prospect of capital growth or rental growth in Brisbane’s apartment market in the near future.

On the other hand there are great investment prospects buying well located houses in Brisbane’s inner and middle ring suburbs where capital growth is likely to continue to perform well.

Read more: Brisbane Property Market Forecast