Domain’s Property Price Forecasts – February 2020

TRENT WILTSHIRE FEB 12, 2020

Property prices should grow strongly in most Australian capital cities in 2020 and 2021. Following rapid property price rises at the end of 2019, prices have continued to rise this year.

We’re forecasting Sydney and Melbourne prices to rise rapidly in 2020, but price growth should moderate in 2021. Brisbane should see strong house price growth over the next two years, and unit prices will also start rising again.

Very low interest rates and the expectation that interest rates will remain low will be the key drivers of rising property prices in 2020.

Strong population growth, a slowdown in new housing construction, low levels of listings and the First Home Loan Deposit Scheme will also contribute to higher prices. In addition, rising market sentiment and a jump in buyer demand, shown by rapid growth in mortgage lending as well as more people viewing property listings, will also push up prices.

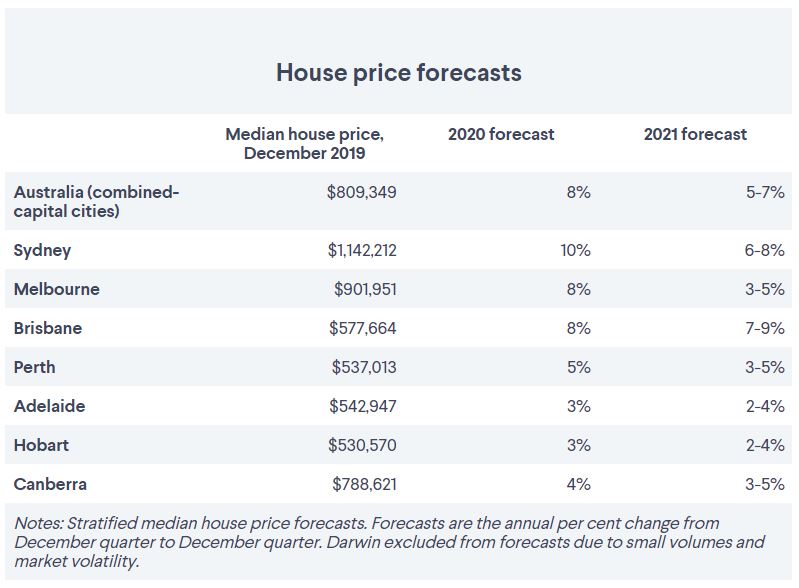

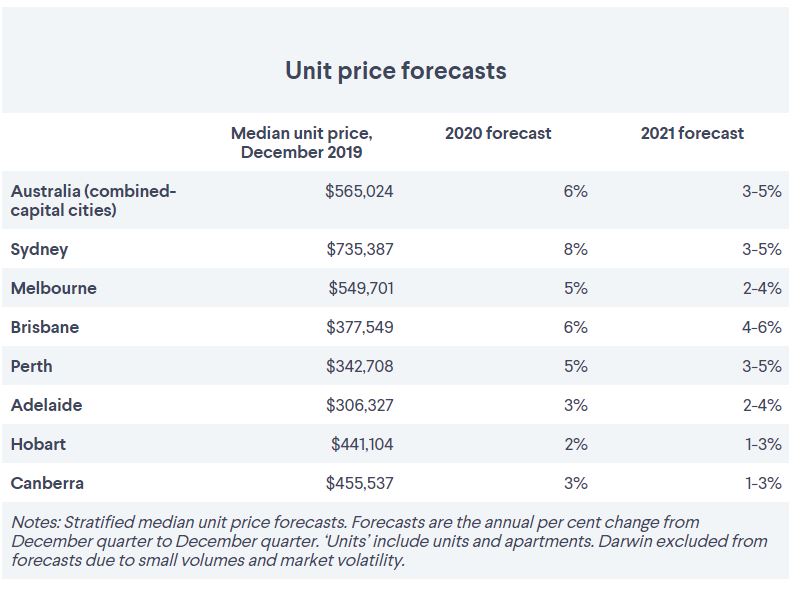

Property price forecasts

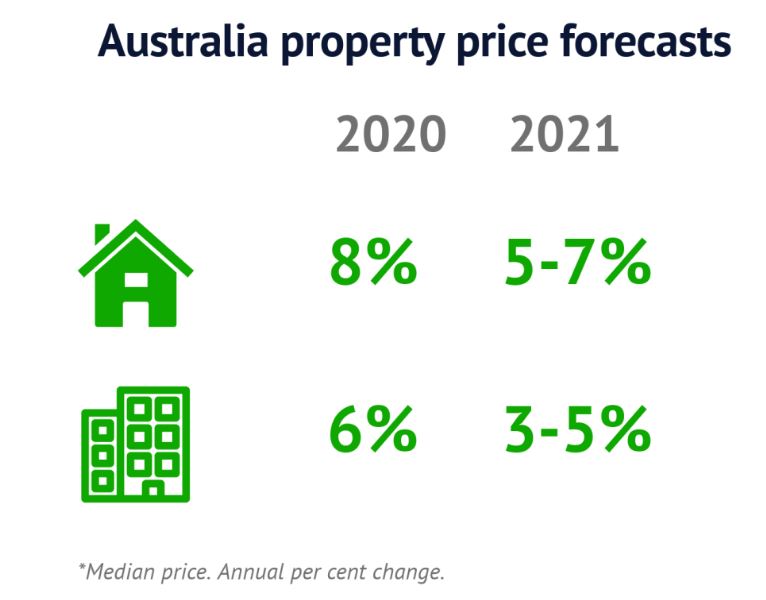

Australia (combined-capital cities)

The combined capital city median house price is forecast to rise by 8 per cent in 2020. In 2021, house and unit price growth should moderate due to stable interest rates and as affordability constraints bite. A pick-up in housing construction from late 2020 or early 2021, as well as more new listings, will also limit price rises.

In the next few months, strong buyer demand will boost prices. Since May 2019, the value of new home loan commitments has risen 21 per cent. Domain’s measure of “views per listing” shows more people are viewing property listings in all capital cities compared to a year ago. People also expect prices to rise further. Property sales, which are closely linked to property prices, are rising again after hitting the lowest point in more than two decades in early 2019.

Price forecasts for 2020 have been upgraded for most capital cities compared to our June 2019 forecasts.

The combined capital city median house price is forecast to rise by 8 per cent in 2020. In 2021, house and unit price growth should moderate due to stable interest rates and as affordability constraints bite. A pick-up in housing construction from late 2020 or early 2021, as well as more new listings, will also limit price rises.

In the next few months, strong buyer demand will boost prices. Since May 2019, the value of new home loan commitments has risen 21 per cent. Domain’s measure of “views per listing” shows more people are viewing property listings in all capital cities compared to a year ago. People also expect prices to rise further. Property sales, which are closely linked to property prices, are rising again after hitting the lowest point in more than two decades in early 2019.

Price forecasts for 2020 have been upgraded for most capital cities compared to our June 2019 forecasts.

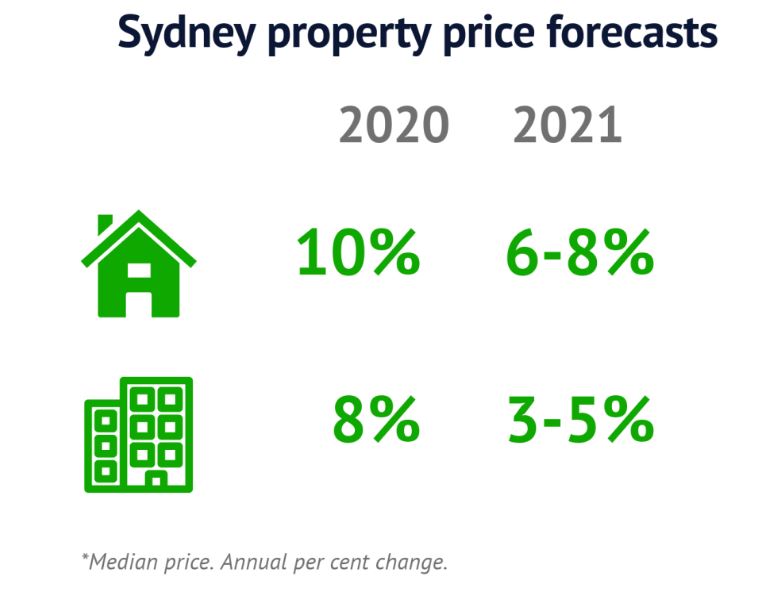

Sydney

We predict Sydney house prices will rise by 10 per cent in 2020, with more modest growth of around 6 to 8 per cent expected in 2021. The median unit price is forecast to rise by 8 per cent in 2020 and then a further 3 to 5 per cent in 2021.

If these forecasts eventuate, Sydney’s median house price will be $1.25 million by the end of 2020. This is 5 per cent above the peak reached in June 2017. For units, the median price will be $795,000 in December 2020, 1 per cent above the peak reached in June 2017.

Prices rose rapidly in Sydney at the end of 2019, particularly in higher-priced areas, with this momentum continuing into 2020. Price growth in preceding quarters influences future price growth, so this is a major driver of the predicted significant prices rises in 2020. Auction clearance rates remain at around 70 per cent, buyer interest remains high, and people expect prices to increase further.

Apartment construction activity will slow dramatically in 2020, which will provide support to unit prices in the year ahead. But construction may start to rebound as early as 2021, which will limit price rises.

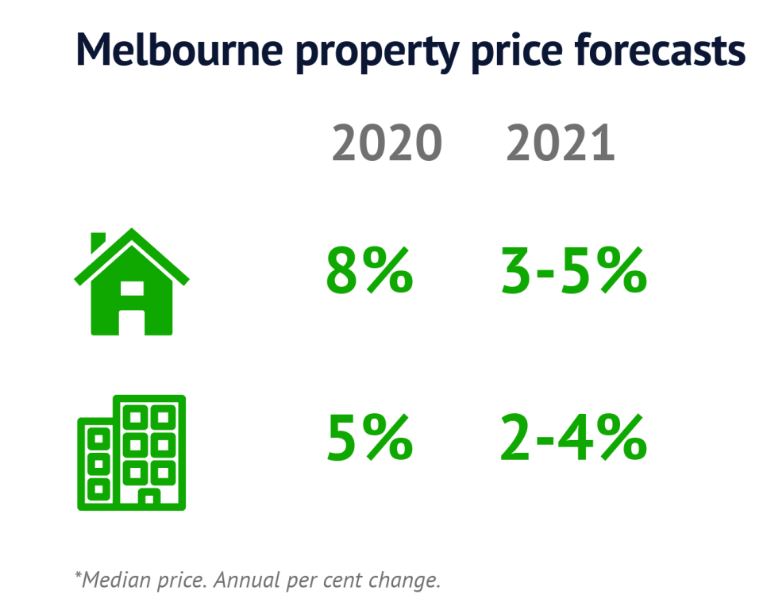

Melbourne

Melbourne’s median house price is forecast to rise by 8 per cent in 2020 and then by 3 to 5 per cent in 2021. This will mean Melbourne’s median house price reaches around $970,000 by the end of this year and will hit the $1 million mark by the second half of 2021. This is 10 per cent above the recent peak of $909,000 reached in December 2017.

Melbourne’s unit prices are expected to grow rapidly in the first half of 2020, following a strong end to 2019, before price growth slows. We’re forecasting the median unit price to grow by 5 per cent in 2020 then by around 3 per cent in 2021.

Strong population growth will continue to underpin demand for housing in Melbourne and support prices. Melbourne’s population is projected to grow by more than 120,000 per year in the next few years. In addition, apartment construction activity will slow in 2020 and interest rates will remain low, both factors which will drive prices higher.

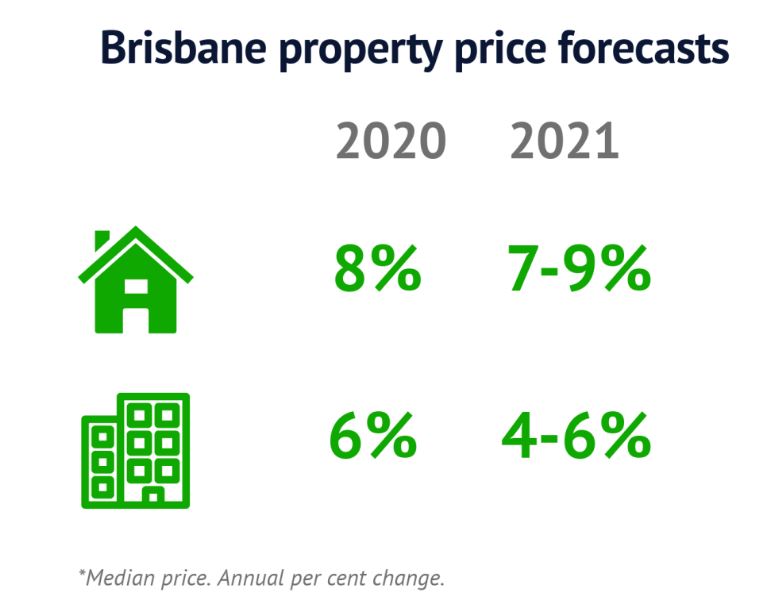

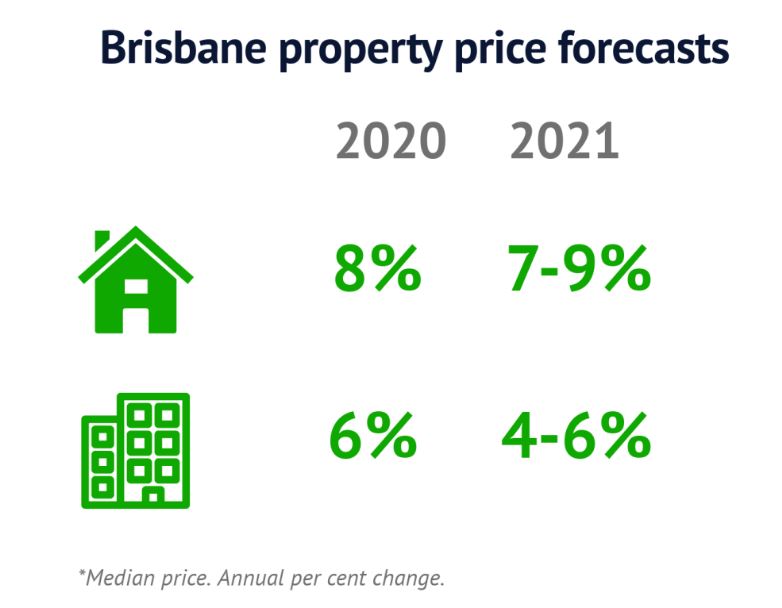

Brisbane

Brisbane house prices are forecast to see strong price growth in the next two years. We predict the median house price will rise by 8 per cent in 2020 and 2021. This follows a period of soft price growth when Brisbane’s house prices rose only 5 per cent in the previous three years.

If these forecasts eventuate, Brisbane’s median house price will be $620,000 by the end of 2020, the first time it’s been above the $600,000 mark.

We forecast that Brisbane unit prices have bottomed out and will see moderate growth over the next two years. After falling almost 10 per cent from the 2016 peak, Brisbane’s median unit prices are predicted to rise by 6 per cent in 2020 then 4 to 6 per cent in 2021. A key driver of this turnaround is that apartment construction activity is reaching a low point over the next year or so. Brisbane’s population growth will also remain strong, with the population growing by about 2 per cent in the coming years.

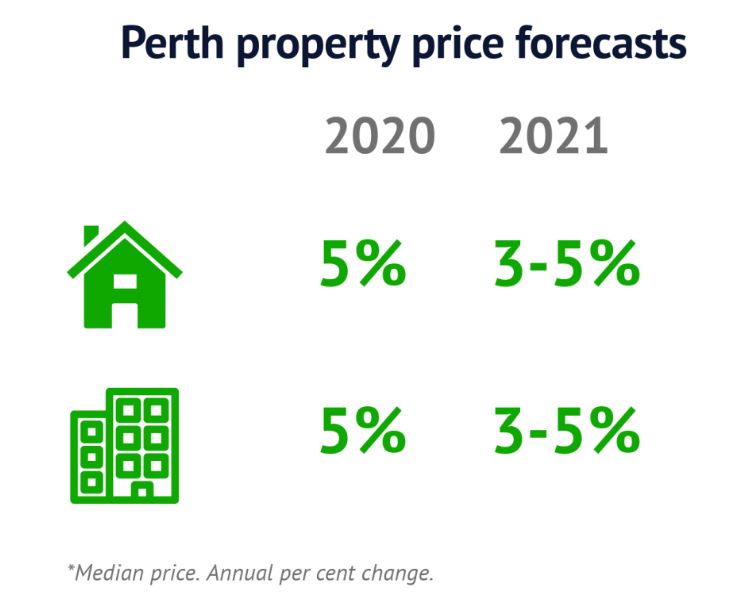

Perth

Perth’s long-running downturn should come to an end in 2020. We forecast the median house and unit price to rise by 5 per cent in 2020 then by around 4 per cent in 2021. By the end of 2020, the median house price should be $564,000, which is still 8 per cent below the December 2014 peak.

Stronger population growth (Western Australia’s population growth is forecast to increase from 1 per cent in 2018-19 to 1.5 per cent in 2020-21), faster economic growth driven by a mining sector rebound, and a tighter rental market are all behind the turnaround.

Buyer interest has also risen, with “views per listing” up over the year and home loan commitments rising 15 per cent between May and December 2019.

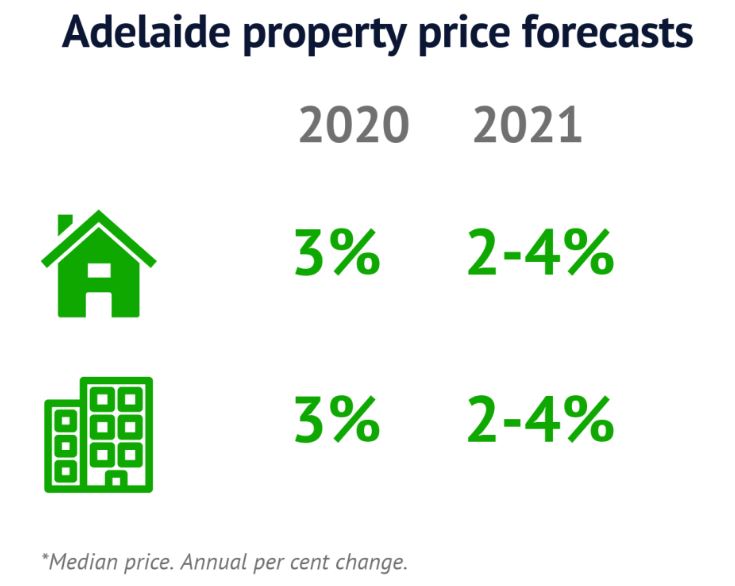

Adelaide

House and unit prices in Adelaide are forecast to rise by around 3 per cent in 2020 and 2021. Over the past five years, Adelaide’s house prices have grown by an average of 3 per cent annually, and unit prices by 2 per cent annually. If these forecasts eventuate, Adelaide’s median house and unit price will be $575,000 and $325,000 respectively at the end of 2021.

There has been a smaller rise in home loan commitments in South Australia since mid-2019 than in other states, which points to a more modest rebound in 2020. A low rate of construction activity matches modest population growth. More potential buyers are looking for properties in Adelaide, but the increase has been smaller than in most other capital cities.

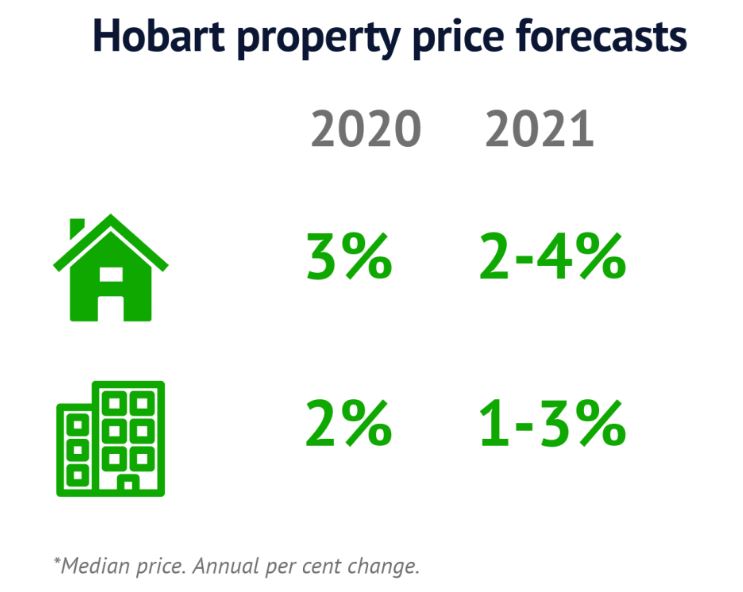

Hobart

Hobart’s property price boom, when house and unit prices rose by over 50 per cent between 2015 and 2019, is expected to come to an end in 2020. Hobart’s median house price is forecast to rise by 3 per cent in 2020 and then 2 to 4 per cent in 2021. Unit prices are expected to rise by around 2 per cent each year.

If these price predictions eventuate, Hobart’s median house and unit price will be around $560,000 and $460,000 respectively at the end of next year.

Our forecast model regards Hobart property prices as somewhat overvalued, meaning a gentle price correction should follow. Home loan commitments are still rising, but not by as much in other states. Tasmania’s population growth is also forecast to slow over the next couple of years.

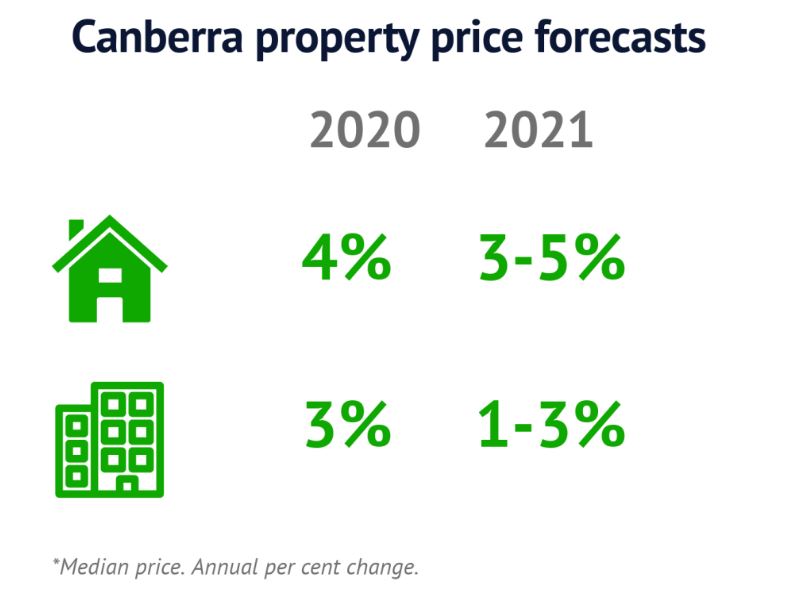

Canberra

Canberra’s median house price is forecast to rise by 4 per cent in 2020 and around 4 per cent in 2021. If this eventuates, Canberra’s median house price will be around $820,000 by the end of this year.

Unit prices are likely to rise at a more modest pace, by 3 per cent in 2020 then 1-3 per cent in 2021.

Rising buyer interest, shown by a rebound in home loan commitments and a rise in views per listing on Allhomes, will support price growth. The ACT Treasury forecasts population growth to moderate, but remain strong at 1.75 per cent over the next few years, which will support modest price growth. The new apartment construction pipeline will contain price growth, particularly in 2020.