Market Trends from Corelogic

August

Market trends are important over the Covid 19 period as these help investors, home owners, buyers and sellers make import Property decisions. Attached is the recent report on Early Market Indicators from Corelogic

August

Market trends are important over the Covid 19 period as these help investors, home owners, buyers and sellers make import Property decisions. Attached is the recent report on Early Market Indicators from Corelogic

September

A SHOCK new broker survey has revealed one in four homeowners given home loans last year would fail new bank tests if they applied today. A SHOCK new broker survey has revealed one in four homeowners given home loans last year would fail new bank tests if they applied today. Everything from Netflix habits, to […]

May

RESERVE Bank Governor Philip Lowe has sparked a frenzy of fresh predictions that rates will hold at 1.5 per cent until 2020 — a boon for homebuyers but hell for retirees. RESERVE Bank Governor Philip Lowe has sparked a frenzy of fresh predictions that rates will hold at 1.5 per cent until 2020 — a […]

March

INTEREST-only loans have crashed to a historic low, a precursor that could spark the next big investor boom in the property market. The dramatic decline came off an Australian Prudential Regulation Authority edict for lenders to slash the loan category to below 30 per cent of all new loans they write. Lenders have gone even […]

June

The Australian Taxation Office allows property owners to claim depreciation, or decline in value, as a deduction. Depreciation is considered a non-cash deduction, meaning an investor doesn’t need to spend any money to be eligible to make a claim. Therefore it is not unusual for these deductions to get missed. With tax time approaching, property […]

May

More supply is just one part of the housing push with a raft of initiatives rolled out in the 2017/2018 federal budget. Photo: Pat Scala Housing was a hot button topic for the 2017/2018 federal budget, so it’s no surprise there were a raft of changes for real estate. The new measures have impacted on a […]

May

There’s been quite a bit of speculation over whether Australia has a property market bubble – where house prices are over-inflated compared to a benchmark – and when it might burst. According to housing experts, there’s at least four scenarios where this could happen. Australia could see a property bubble burst due to: Lending tightening, […]

August

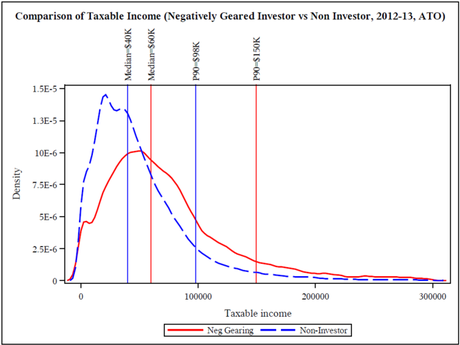

Average income earners largely are the people who do get to take advantage of negative gearing – nurses, policemen and women on an average wage, investing, for instance, in a property. Most of them hold only one property, which adds to the housing stock that’s available for people as well. – Assistant Treasurer and Small […]

March

Often property investors rent out their property fully furnished. Claimed Depreciation. Depreciating furniture can add thousands of dollars to the owners depreciation claim. The below table provides an example of the difference that claiming depreciation on a $16,000 furniture package could make to an investor who purchased a two bedroom two bathroom unit: It is […]

October

Download the full chart pack here. Capital city home values increased by 0.1% in September, 2.9% over the third quarter and they increased by 9.3% over the past year Home values increased by 0.1% across the combined capital cities in September and rose by 2.9% over the three months to September 2014. Over the month, […]

January

CONFIDENCE is back in the Queensland property market with home sales driving a post-GFC revival. The Sunshine State has highest level of confidence in the country according to a survey of 2,600 construction and property professionals. The Property Council/ANZ Property Industry Confidence Survey has predicted a 20 per cent leap in sales volumes this year. […]

May

Lenders have been offering a variety of incentives to borrowers as interest rate fluctuations focus peoples’ attention on whether to switch lenders. Queensland-based lender Firstmac is offering a three-year family membership to Brisbane Broncos rugby league team on its 5.21% (5.26% comparison rate) Broncos loan. Loans.com.au is offering a special rate of 4.75% (4.77% comparison […]

May

Since the Reserve Bank left the rates on hold yesterday at three per cent, experts have started to suggest that the next movement we see will be an increase. While many saw yesterday’s RBA decisionas disappointing, it was actually fitting, said LEDA Real Estate’s CEO, Barry Goldman. “With key areas of the economy tracking well, […]

May

The following results are based on advertised mortgage rates listed by ratecity.com.au, Mozo.com.au and infochoice.com.au as of November 7: Lowest variable rate offerings: Provider Loan name Rate Comparison rate* Loans.com.au Dream Catcher blackboard special 5.42% 5.44% My Mortgage Freedom Low rate (LVR up to 75%) 5.43% 5.74% UBank UHomeLoan refinance only 5.47% 5.47% Lowest one-year fixed-rate offerings […]